I recently spoke to a founder who had won first place in a six-figure pitch competition. She was excited about getting funded but was blind-sided by a common trap that isn’t talked about enough. She was raising and just had a great response to her pitch. But she still needed to show that her idea actually had enough merit before investors took out their checkbook. She hadn’t passed this critical step, so her first serious investor sit-down conversation fell flat, much to her dismay.

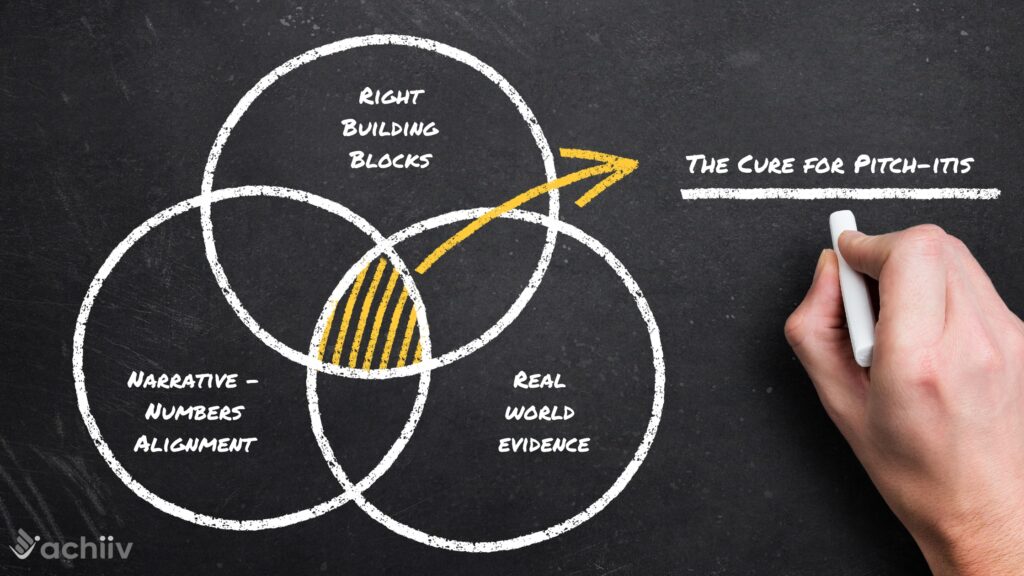

The early stage startup world is obsessed with pitching. There’s a demo day or a pitch competition happening everyday. But there’s almost no guidance or support I’ve seen that helps you systematically build an ironclad financial story. I call this malady “pitch-itis”.

But the good news is, if you do suffer from pitch-itis, you’ve got nowhere to go but up. To cure it, you need to flip your focus 90-10 financial story to pitch, instead of the other way round. Then building a convincing pitch deck becomes almost automatic, selling your story becomes easy, whether it’s to investors, customers, or even potential hires.

How To Tell If You’re Suffering From Pitch-itis

Here’s a classic example: I talked to a founder whose startup uses AI to make buildings grid-independent. He painted an inspiring picture of what the world would look like once his solution hit the market: building energy costs would plummet, the world would be a cleaner place, and power outages would become a thing of the past, even when a hurricane hit. What could go wrong? But when I started probing exactly what this would look like on the ground, he faltered. There was only air.

Made Up Numbers

Pitching a grand vision is necessary. It’s important to aim high. But when you’re unable to step down from your vision into the specific building blocks that will make it a reality, you’ve fallen victim to “pitch-itis”.

Have you projected impossibly rosy revenues? You might have caught pitch-itis. Check for these other symptoms too:

- Gigantic market size estimates with no building blocks to explain the math

- Puny investments (marketing, sales, plant) that realize huge gains in sales and revenue

- Inability to explain revenues in terms of “widgets sold”, not “dollars generated”

The Missing Roadmap

The question is, do you as a founder know how you’ll navigate from Point A to Point B? What are the waypoints you’ll hit on your journey to your vision? How long will that take? What supplies do you need? If you can’t explain that, you may have a case of pitch-itis.

For example, if you’re creating a revolutionary new battery technology, but can’t explain even at a high level how you’ll take it to your first market, you’ve got a missing roadmap problem. How will you scale production, navigate regulatory hurdles, or secure important partnerships? If you don’t even have an ingoing hypothesis, investors won’t trust that you’ll “just figure it out”.

Can You Prove It?

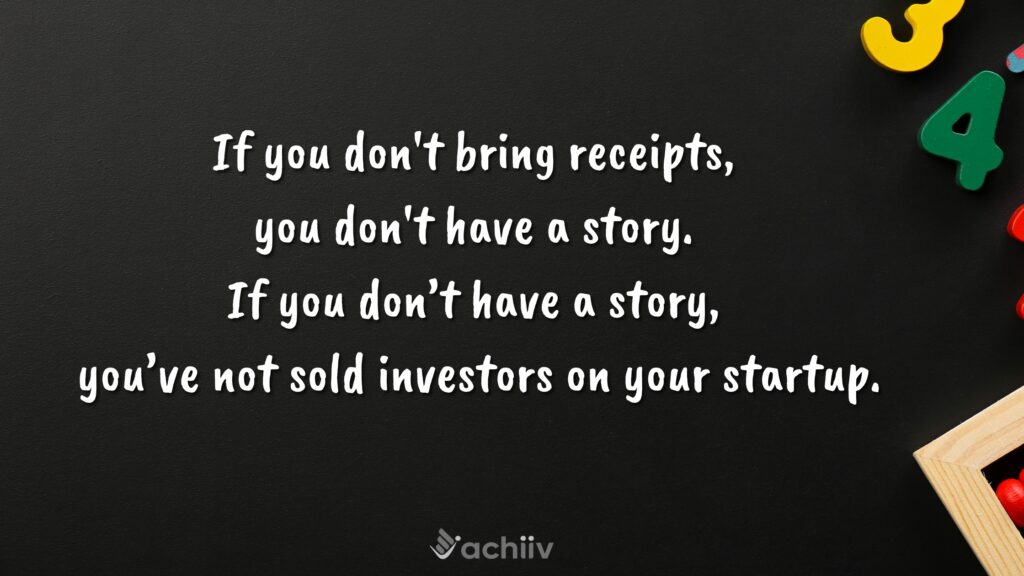

Investors want you to build that big castle but you should have at least a table scale model or some bricks to show for it when you talk to them. For example, if you’re aiming to build a great new clean-tech product, show up with even a tiny working prototype, not just a design.

Startup investing is pretty simple: If you don’t bring receipts, you don’t have a story. If you don’t have a credible story, you’ve not justified investing in your startup. There’s no further conversation.

How To Cure Your Pitch-itis

In working with founders, I’ve found that three steps will get you most of the way there:

Build On Strong Foundations

Before you do anything else, break down the core components of what makes your startup viable, and test it to make sure it creates a compelling story:

- Market opportunity: What is your market? How big is it? Why is it attractive?

- Product & pricing: What is your product? Who will pay? How will it make money?

- Channels: How will you reach your market? How easy and expensive is it to access?

- Profitability: How much profit will you generate? Are the profits sustainable?

- Growth: How big will you grow? How fast? How will you fund this growth?

Start with the simplest answer you can articulate and go deeper as you test your footing step-by-step.

Match Narrative to Numbers

Your pitch delivers a killer narrative. But the key question in investors’ minds is, how well does it line up with numbers? Every element of your pitch should be connected to a number or verifiable fact you can explain and defend.

Many founders mistakenly believe that the only place numbers count is in the projections. Investors know better. They’re pressure-testing every part of your pitch against a number or fact they can bank on.

If you’re targeting a specific customer segment, your market sizing should support why it’s attractive. If you project rapid revenue growth, your channel strategy should demonstrate how you’ll acquire those customers. If you aim for high margins, your cost structure should support that claim.

This integration of numbers is seamless and inseparable from the narrative. Build the numbers into your narrative from the get-go and save yourself the heartache of investor skepticism.

Test and Prove Every Number

Investors are always checking receipts. By the way, you’re your startup’s biggest initial investor and are investing something much more valuable: your time. So plan to look for and collect receipts for every part of your pitch – this will ensure your ideas and plans are rooted in reality.

Think like a scientist. Be surgical in your approach. Boil down every building block of your story into small experiments. Do the experiments, whether it’s talking to people or collecting real world data. You make an assumption, you test it, you learn, you refine. It’s a continuous cycle of improvement.

A nice bonus is that you’ll be able to effortlessly explain and defend virtually every part of your financial projections. You’ll ooze credibility because you’ve demonstrated a rational thought process that’s very similar to how investors think. They’ll accept you as one of their own – as someone who gets it and can be trusted with their money.

How to Tell If You’re On Track

A few simple tests are sufficient to see how well you’ve vanquished pitch-itis:

- The What Test: Can you explain every part of your plan in simple terms that even a fifth grader can understand? Can you connect the dots between all the parts?

- The Why Test: Can you defend why your plan is achievable with a series of steps and building blocks that make logical sense?

- The How Test: Can you explain and defend how every part of your grand plan shows up in dollars and cents on your pitch’s numerical twin, i.e., your projections? Can you draw out the biggest make-or-break assumptions and “need-to-believes”? Can you explain relationships: “If we do this, then it changes the results that way”

Building startups is an endurance sport. There are challenges at every turn. Curing your startup of pitch-itis is your best bet to tackle them successfully. Along the way, it gives you energy-boosting confidence when you’re hit with issues like:

- Investor A says you need to do X. You go to investor B who’s equally credible but says the exact opposite. Which of them is true? Where do you go from here?

- How can you know as the founder that you’re investing in the right opportunities?

- You can talk technology until the cows come home but how do you convince investors?

- You’re a nontraditional founder who needs to build trust fast to progress your startup. Where do you start?

The single best solution to all of these challenges is to have your ironclad financial story straight from day one.

When are you going to start building yours?