Recently, I was reviewing the pitch deck of a startup that was preparing to compete in a “Shark Tank” event with meaningful prize money. As we started, one of the founders said “We’ve been talking to ten different experts and have received ten different opinions on how to structure this deck”.

That got me thinking – the startup space is drowning in advice, templates and pitch decks used by unicorns. So why do so many pitches fail to hold investors’ attention even for a few minutes?

After working with dozens of founders, I found out why: founders think that the pitch is a magic key to unlocking investors’ checkbooks. In reality, it’s the one and only “sampler” investors use to see if a startup is worth any more of their precious time than the couple of minutes they give to your pitch. Their default assumption is “no”.

When you understand this fundamental reality, you can focus your energy on architecting your pitch to skillfully rebutting every one of the silent “no’s” in their minds – in the way that’s most compelling for your startup.

Nullifying the “No’s”

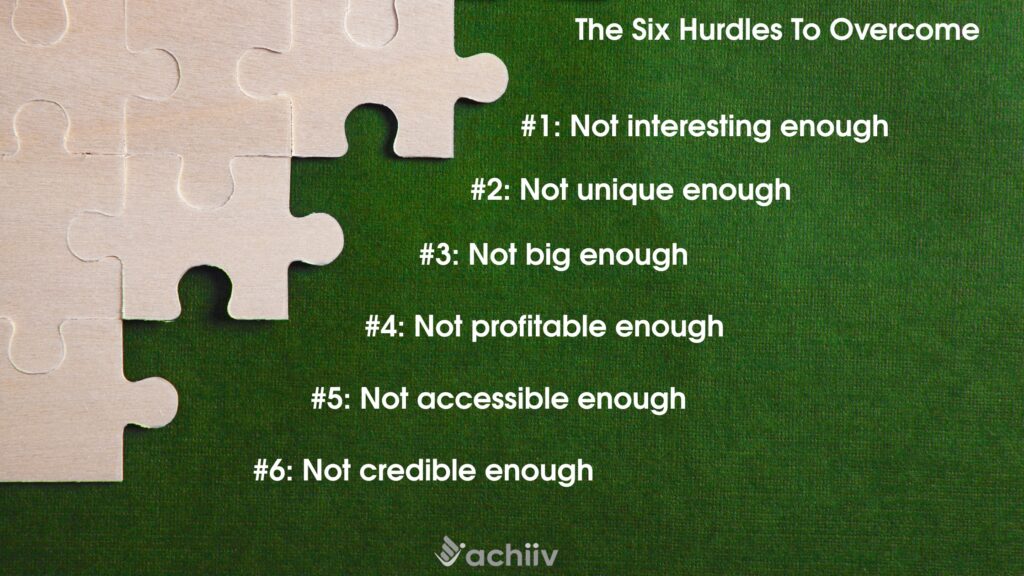

There are six “no’s” an investor walks in with when looking at pitches. Your job is to skillfully turn every one of their “no’s” into a “yes”, so the only logical conclusion left for them is to take a deeper look.

No #1: “Nothing to See Here”

Investors are like distractible toddlers – if you don’t give them a quick reason to pay attention, they’ll just drift away. Overused claims like “disruption” and “game changing technology” only make them yawn.

To get their attention, you must start with the one thing about your startup that will make them sit up and take notice:

- Have a surprising fact or take on the problem? Then start there. e.g., “No EV today can take you from New York to San Francisco without a battery recharge. What if we could change that?”

- An event made you change your life course? Then start with the story. But only if

- it’s far removed from everyday experiences and/or

- it so deeply impacted you that you felt compelled to change your life course to solve it. e.g., “I got frustrated with wait times at the doctor’s office” as the opener for your scheduling platform isn’t recommended unless your background is a “made-in-heaven” match.

- Start with the product only if it’s so far ahead of the status quo as to appear almost unbelievable (provided of course, you can back up your claim)

No #2: “Not Game Changing Enough”

Product matters, but not in the way you think. Yes, investors want to know it works. But what they care about more is why your customers would bother to switch. What’s the “wow” factor that makes them overcome their innate inertia and make the switch?

To get investor attention, forget the bells and whistles. Instead, sell benefits and impact. Most of all, sell real-world proof that your customers love it and can’t wait to get their hands on your product. Traction trumps everything.

No #3: “There’s No Real Market There”

Here’s another no-no: founders who zoom in too much on their problem and don’t stop to think about actual market size. They waste the market size slide with superficial numbers they neither understand nor can explain.

Market size is one of the first and biggest filters investors use to qualify startups. Investors know there’s as much risk in a small market startup as there is in one that attacks a big market. There’s little to no chance for investors to make big returns in small markets, so they’ll simply pass.

To convince an investor that there’s a big “there” there, don’t just pull a big number that ChatGPT or some obscure industry report gave you. Ensure you understand and can explain what makes up that number, and how your startup is going to be able to access this market to grow quickly.

The bottom line: Can you justify market size in terms of unit size rather than dollar size?

No #4: “It Won’t Make Enough Money”

The biggest pitch mistake founders make: spending 70-80% of the pitch on the problem and/or product features, and almost nothing on how they’ll grow and make money. This is exactly the wrong balance. Investors care more about how you’ll make money in a scalable way than they ever will about the nitty gritty of the technology you love so much.

Focus your story on how you’ve thought through pricing and product definition so you can kickstart fast growth. I once worked with a founder selling a technology solution to universities. Instead of volume and usage based pricing, they charged on a per-university basis. That’s an instant turnoff to investors because there’s no way you can scale revenue by charging that way.

Worse, it shows investors that you have no grasp of what drives revenue growth and how you set up your startup strategy to tap that growth.

There’s more. A big factor is the size of your margin – the profit each unit sale generates. Investors love high margin businesses like software because sales growth generates a disproportionate amount of margin.

Investors want to see evidence that you can charge a relatively high price and incur a relatively low cost to deliver each new unit of your product , e.g. “65% gross margin”

No #5: “You Can’t Access Customers Profitably”

First time founders focus on product while repeat founders focus on distribution. Lack of scalable distribution is the biggest killer for attractive products with big markets. Early on, you’re the one evangelizing the product to the first customers. That’s completely appropriate because you need to be engaged first-hand with customers.

But investors want to see how you’ll move to a scalable and profitable distribution strategy once you’ve achieved product market fit. In fact, the biggest key to making your growth projections believable is to back it up with a distribution strategy that shows investors the exact details of how those numbers will be achieved.

For example, don’t show a vague “go to market” slide with poorly defined terms like “Dealer distribution”. Show an understanding of how many dealers you’ll need and what kind of sales they’ll have to deliver for you to be able to hit your revenue growth goals.

You may not have the numbers exactly right, but the logic has to be rock solid.

No #6: “It’s Too Much For This Team to Pull Off”

They say the way to hell is paved with good intentions. The way to startup failure is paved with plans that the team can’t execute. Investors are keenly attuned to the exact steps a startup needs to take to prove the opportunity, the caliber of the team lined up, and the realism of the investment needed to make it happen.

Be that rare founder that shows:

- Specific, tangible milestones with dates and metrics that you plan for the next 12-18 months to prove your opportunity

- A high caliber proven team with expertise aligned exactly with the planned milestones: e.g. strong product expertise for product milestones

- A clear, realistic and believable budget to get all of this done. Round numbers are less credible if you can’t back up how you arrived at those numbers

The Real Road Test For Your Pitch

When you’re sure you’ve got the right elements and lined up a story that flows like water, test it with this timeless trick they taught us in consulting:

Read off the title of every slide in order without looking at the contents:

- Did it grab attention instantly?

- Is it clear what you’re selling and why?

- Does it answer the next logical question in the reader’s mind naturally?

- Can you “double click” on any element and provide proof?

Now do the scary part: Show it to an outsider who knows nothing about your business and ask them – can they explain what you sell and how you make money in 30 seconds or less?

Congratulations! You’ve just made the cut.

If not, what changes does your pitch deck need to make it pop?