She got the call with barely three days to prepare. An influential investor wanted to discuss her idea and potentially also help her recruit her cofounder. She’d been preparing her pitch deck for weeks, toiling away on the vision, the market, and product for a unique and innovative B2B platform. With some luck, she’d finally start to get some resources. Because it was a pivotal meeting, she arranged for a brief consultation with an expert to help sharpen her pitch deck.

But alas, things didn’t go quite to plan. Instead of being inspired by her vision, the investor looked thoughtful, asked her several probing questions, and finally declined to participate. He had poked enough critical holes in her thesis to not only pass on the opportunity, but had also crushed her confidence in the process.

Why did the expert not fix her pitch? Where had she fallen short?

When “Common” Sense Makes No Sense

To build her startup, our founder had used the approach long preached by the popular startup crowd:

- Get idea

- Do customer discovery

- Build MVP

- Create a snazzy pitch

- Raise

- Go build the startup

But what she found, like so many others before her, is that a pitch built this way rarely survives first contact with a serious investor. And trying to get expert help right before going to pitch hardly helps – it’s as effective as going to a roadside mechanic to fix a broken car. At best you may get a solid diagnosis. But you definitely won’t get a car that’s roadworthy for a 1,000 mile trip.

The biggest revolution in car manufacturing came when Toyota did something completely counterintuitive – they insisted on stopping the entire assembly line every time a defect was discovered in a car anywhere on the assembly line, regardless of the profit consequences, until it was fixed. Shockingly, this process produced better cars faster and cheaper.

If you’re a founder who wants to build a high quality startup, you need the Toyota kind of discipline that goes against every inner instinct that’s screaming at you to “just build the thing” and fix everything “later”.

But how do you set up your startup assembly line in the right order? How do you know what comes first and what follows? Why does the traditional approach fail so often, even though it sounds so logical, just like conventional car manufacturing wisdom did before Toyota came along?

The Eye of the Investor

Let’s flip the script for a moment and step to the other side of the table. When an investor first looks at your pitch, they’re putting your idea through a mental assembly line. But what makes this line interesting is that there’s no skipping steps in the sequence.

As you go through your pitch, the investor is asking herself:

- Is this problem worth solving?

- Is your solution 10X better?

- Is your market big, hungry and plump in the pocket?

- Is your revenue model robust?

- Does your customer acquisition plan make sense?

- Will your product make money in the long term?

- Is your roadmap realistic and feasible?

- Can you and your team pull it off?

- Will this make money for me?

If your pitch fails to convince her on any of the upstream questions, the process is over. She won’t care for your amazing story downstream. Your “defective” pitch gets rejected.

Market First and Always

Founders typically neglect to follow a structured process to answer all these questions systematically and thoroughly.

For example, of all the founders I talk to, few have gone through the discipline of really proving to themselves that they have an accessible market their solution can tap right now. It’s much easier and more common to pull a perfunctory market size number from an industry report and move on. But if you haven’t gone through this process and convinced yourself of the size, how can you expect to convince a skeptical investor?

This was the first mistake our founder made – she hadn’t stopped to check for herself how big her market realistically was, for HER solution. She also lost a golden chance to sell her investor at “hello”.

You Can’t Make it Up on Volume

Steve Blank famously said, “Startups don’t fail because they lack a product; they fail because they lack customers.”

Many founders don’t know the full quote, which is: “Startups don’t fail because they lack a product; they fail because they lack customers and a profitable business model.”

And this was really the heart of why our founder failed to make an impression: she lacked a viable business model.

As you pitch, an investor is silently asking:

- Which specific customers / segments will you pursue tomorrow?

- Do you have a solid revenue model? Is your pricing credible?

- Do you have channels lined up ?

- How much will you need to spend to get your product to your customer?

With the popular startup building approach however, there’s no systematic way to test and prove these other parts beyond your “Minimum Viable Product”. Many first time founders seem to think that once the product is defined, these four elements will somehow sort themselves out, or are just details to be addressed “later”, once the investor’s funds are safely in the bank.

Our founder, for example, had barely made a mention of the actual price points for her product, or the specific channels she’d use to get customers: not nearly enough for an investor to pressure test it in any meaningful way. The result was that the investor simply had no basis in which to give her money – he couldn’t be sure how she’d use it to make her startup less risky and more valuable with that funding.

Execution Matters Only On Good Ideas

What all of this means is that if you’ve been producing a defective startup, the investor will never get to see or care about all the other amazing parts of your story – whether it’s your team or technology.

Not to mention that they have no reasonable basis on which to evaluate your fundraising ask.

It’s not only true that good ideas are a dime dozen but execution is hard to find. It’s also true that “Just do it” execution is chasing a lot of terrible or poorly vetted ideas.

Real Life Impacts

Real Life Impacts

What does all this mean for you? It means paying as much attention to all parts of your story as you do to your product and team. Use the same assembly line sequence your investor uses. And most important – don’t waste time on downstream elements unless you’ve thoroughly proven and tested every upstream element.

If you haven’t done that, a quick consultation with any expert isn’t enough to suddenly make your startup fundable.

So what can you do right now to build a startup investors love?

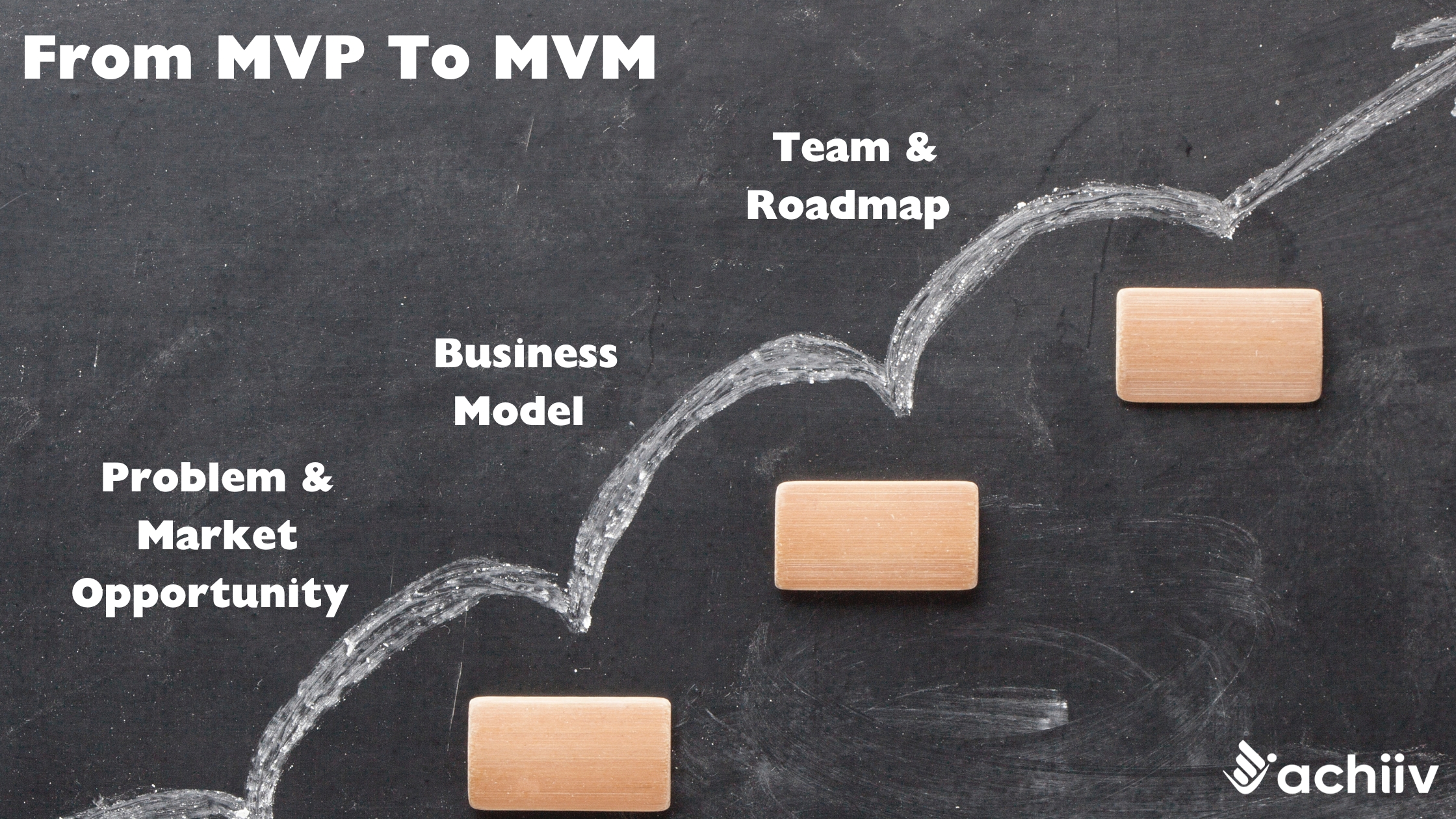

Set up your startup assembly line in the right order:

- Problem and market opportunity

- Business model

- Roadmap and team

And don’t proceed until you have established your MVM – your Minimum Viable Model, at every step of the line.

Which step of your assembly line do you need to work on right now?

Want more like this? Sign up now for Seed2Success from Achiiv – the weekly digest with insightful podcast episodes, financial storytelling advice, actionable tips and more – 100% free!