I see many smart early-stage founders whose pitch decks completely skip the financials, or provide a cursory set of numbers that are just a few columns built by brute formula. When I ask them about this, the usual response is “Well, investors don’t care about models”, or “Well, we know it’s wrong anyway so we don’t see the point of building it out”.

They are wrong on both counts.

First, investors DO care about models even in the early stages. It’s not because they think you’ll hit the numbers or even that you know how the business will turn out. It’s because a model is the best tool an investor has to understand how well you know the business you’re looking to build. For example, what you need to do to generate repeatable sales, what drives the profitability of your product, or how much capital you really need for the next step.

But there’s a deeper reason too. Investors want to know if you understand not only your specific domain, whether it’s medicine or climate. They want to know if you have a solid grasp of business itself, so they can trust their valuable dollars with you and your startup. If you can’t have a substantive conversation about what will make your business tick, most easily done via a model as the facilitator, it’s hard for an investor to believe you can drive the bus to where you need it to be without burning up a lot of time and money.

Lack of a thoughtful model flashes a bright red “no” in investors’ minds. Getting started early with a model, even if it’s only a diagram on the back of an envelope to begin with, is your best insurance to protect against these risks.

Why Wrong Models Matter

There’s a fundamental truth about models most founders miss: All models are wrong but good models are wrong in the right way. Done right, these “errors” are so valuable that they could save you months and potentially thousands of dollars in wasted effort now and in the future.

But you can only extract the juice if you design your model to be correctly wrong.

Here’s what makes a “wrong” model your superpower:

Diagnostic Dynamo

Going in, you know almost nothing for certain about virtually every part of what’s going to become your startup: How well is your marketing spend working? What percent of sales come from each channel? What is the cost to acquire a customer in channel X versus channel Y?

When the results (e.g., sales) come back differently than you expect, as they will for certain, you want to be well-positioned to use that knowledge (and money already spent) to do better next time.

Did you not attract enough leads, or did you just do a shoddy job converting them? Or did you do a good job attracting and converting leads but they just didn’t buy as much as you thought they would? Or did more sales come from a particularly expensive channel?

A good model is a diagnostic powerhouse. It will help you see the blow-by-blow picture of how things play out, so you can pinpoint exactly where things went off-track. You’ll fix issues a lot faster, and do it better and at less expense than you would by shooting in the dark.

Experiment Engine

Getting important parts of your business right can feel like an endless game of hide-and-seek. Where is the ideal price for this product hidden? What kind of sales incentives should you offer to your channel partners? What will swapping out suppliers with longer lead times do to your cash flow and inventory?

Having a healthy model will allow you to be a fortune-teller of sorts by predicting what the results are likely to be in all of these scenarios. By playing around with important variables, you’ll have better guesses for where to peg things like price right out of the gate.

But it doesn’t stop there. As you learn more about your market and business, you can continue to use your handy little model to conduct even more “thought experiments” to find new ways to win, create value and build buffers around your business. All before you spend a single penny or waste a single hour in scattershot actions.

Reality Reveal

A lot of what drives your startup’s destiny is outside your direct control. Input costs, market salary levels, interest rates – these are all pretty much a given that you have to deal with.

But you have to make important calls today without knowing how they will play out in future. If you build in clear assumptions as well as your rationale for those assumptions on these important drivers, you’ll have built yourself a simple but powerful early warning system about when and if bad things might start to happen. If you have to spend much more for marketing expenses or staff hiring, for example, you’ll know in advance that cash will run out sooner than you planned.

Safety Shields

As chaotic as your startup path is, there are definitely steep cliffs and dangerous depths you don’t want to go near – like running out of cash earlier than planned. If you’re anticipating extra spending on a key resource, or considering big discounts for a big name customer, your model might start flashing red to alert you about running out of cash or dipping into negative margin territory for a long period of time.

The exact numbers will never be perfect, but the light they shine is bright enough to help you see and stay off the path to danger.

How to Start Fixing Your “Wrong” Wrong Models

Okay you’re sold. Where should you start? Especially if you’ve already built a model that won’t pass the sniff test?

The single root cause of bad models is opacity – about causes and outcomes, about what drives your business, your margins of safety, and the mechanics of the math in your model. So the secret to fixing bad models is to start looking for and eliminating opacity in your current model.

Here’s how:

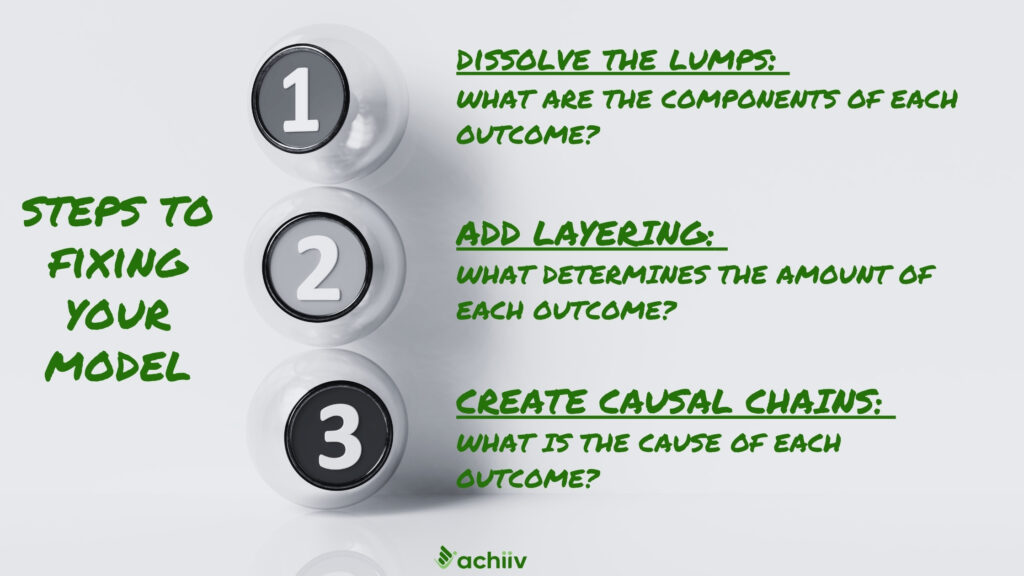

Dissolve the Lumps

One of the biggest signs of bad models is “lumpiness”. Lumpy models aggregate results at such a high level that it’s impossible for an outsider to understand the layers that make them up. For example, you forecast revenues as a single number without showing how they break down by product line or customer segment.

Start with your current model, specifically with revenues. If it’s a single line, dissolve the lumps by breaking it down into components: product lines (e.g.different equipment configurations) , sources of revenue within product lines (e.g., product sale, installation fees, maintenance contracts), segments (e.g. heavy industry, OEM’s) etc.

This step alone will add significant insight and transparency to your model and help you debug it further.

Build in Layers

Much skepticism arises and more than a few mistakes creep in because a lot of models compress multiple steps into a single number. For example, if you’re selling renewable energy, your revenue may be a calculation involving five steps that many founders compress into a hairy formula in a single cell. Bad move.

Contrary to what you may believe, there’s no cost to using extra space to think (or calculate). As you translate how your actions turn into results, make every single step of the process visible through a separate step or layer to show what happens.

These steps create a transparent “calculation waterfall” that shows your watertight logic to investors, minimizes mistakes, and helps you easily see how you can optimize that part of your business.

Create Causal Chains

It’s much easier for you to understand and explain how you’re going to generate the results you’re showing when you understand the cause-and-effect chain behind them. Integrate this thinking into your model by taking every outcome you care about (e.g. sales) and working back to “first cause” actions that will generate them (e.g., marketing spend or sales activities)

You’ll know you’re done when you can clearly explain how and why the actions you’re taking (e.g. attend trade conference, spend marketing dollars) will result in the outcomes you want (e.g. paid pilot). An additional bonus is that this process will also surface assumptions (e.g., your beliefs about which channels produce results) that you can clearly codify and test later.

Will these steps get you all the way there? Of course not! But your job as the founder-CEO is not to be a spreadsheet geek. It is to have a thorough command of what drives your business, where you plan to take your ship and how to get there like a pro.

And that’s exactly what these steps will equip you to do.

What will you do first to build your model the right way?