The founders behind this startup were extremely talented – deep expertise, impressive traction, and solid names in their market as advisors and potential clients. They had just built out their first full financial model prior to talking to investors.

The question: did it make the cut?

Founders tend to focus on the outputs of the model: is the revenue high enough to interest investors? Is the growth fast enough?

But investors approach your model from a completely different place. Specifically, they’re testing:

- Is your model readable? Is it clear where it begins, and where it ends?

- Is it built well? Will it resist breaking? Is it designed to self-correct?

- Is it easy to spot the vital few factors that will make or break your results?

- Is the chain of cause and effect easy to follow for sales, revenue, costs, cash burn, profits?

- Can it be changed quickly to reflect different eventualities, to understand impacts?

If the model doesn’t pass these initial smell tests, the actual outputs are irrelevant because they’re not credible. It’s easier for investors to pass on the opportunity than to dig for answers because they can’t trust that you know how to drive results.

How to Get There: The Four Steps

As a founder, translating this end goal to action can be daunting. It becomes a lot easier if you build your model the way you’d build a house: thoughtfully constructed, affordable within your current means, but planned for future growth, able to accommodate changes along the way.

Don’t start with the dreaded blank spreadsheet. Spare yourself the headaches, break down your model building into four separate steps.

Step 1: The Conceptual Model – A Strong Blueprint

A house becomes a house only if it has some essentials: a kitchen, bedrooms, bathrooms. Some may be more fancy, and others humbler, but the core always remains the same. For the house to be functional, not only are these components essential, but they also need to fit together in a way that makes sense and “flows” with how you live your life.

Before you build your financial model “house”, sketch the design of these essential parts, ensuring the must-haves are there, and fit together logically: the flows of how you generate revenue, how you produce your product, how you accommodate critical inhabitants , aka, business functions, inside the structure.

I often see founders trying to retrofit their business into the constraints of purchased modeling solutions without a strong conceptual model to begin with. Even if you’re using off-the-shelf solutions, create the conceptual model offline first, to save yourself a lot of pain later. This is the blueprint that will ensure your built structure is strong, resilient and flexible.

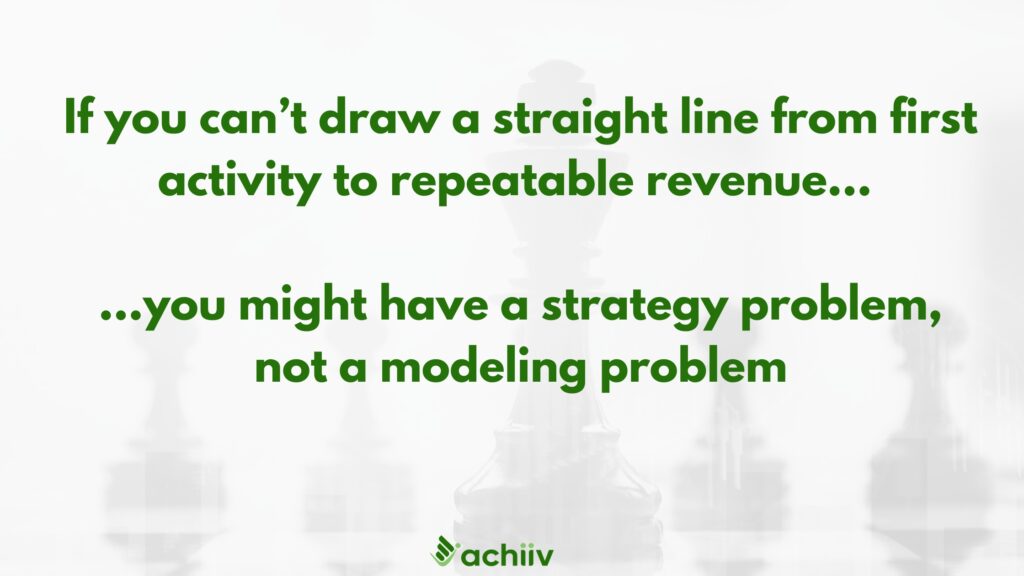

You’ve passed the first test if you can draw a straight line from first activity to revenue, even if it will take years. If you don’t, you may have a strategy problem, not a model problem – fix that first!

Step 2: The Structural Build: Ensuring Stability

The structural build of your financial model is where you take the blueprint, and assemble the materials and connections you need to make the whole thing stand in three dimensional space.

- What are the mechanisms you need to derive sales figures, calculate costs and figure out cash needs?

- How will they connect with each other?

- What “materials” do you need – constants, variables, inputs , assumptions.

- Where will you find them, and how will you test their strength?

Build out the house room by room, checking to see if the dimensions adhere to the blueprint, and provide space and functionality for the intended use. In practice, this entails a three-part build:

- Setting up the critical raw materials: assumptions and inputs

- Setting up and testing the load bearing structure – the foundations, walls, ceilings: calculations and linkages between business drivers and financial outcomes

- Executing the build – pouring concrete, filling out the structure: creating and testing the flow of all the calculations from the inputs into the key outputs that will determine your results

A great check for this step is when you can back-trace every critical number in your outcomes: revenues and costs especially, all the way to the initiating activities.

Step 3: The Furnishing: Functionality and Livability

To make the house “yours”, you introduce the specific combination of furniture and fixtures that fit your living situation. This is the configuration of inputs, assumptions and variables that make the financial model unique to you. For example:

- What realistically can you invest into generating sales?

- What results will they produce? When?

- How much do you expect to spend on costs, when and why?

Arranging these inputs in cohesive and logical patterns makes it easy to understand exactly how they fit together, just like with furniture. You’ll also make it easy to move things in and out without having to break the house down because of poor planning.

Step 4: Safety and Readiness: Adapting to Change

Even the most meticulously designed house needs to accommodate changes and different inhabitants. A new occupant might move in, a family might expand, or bad things can happen. Build your financial model with similar eventualities in mind:

- Create a separate “play area” so investors can get their hands dirty without affecting the rest of the house – scenario functionality is critical for better business understanding for founders and investors

- Build modularly – so you can swap in and swap out whole sections without bringing the rest of the structure crashing

- Install alarms for safety – put in safety checks so lights flash automatically when something goes wrong (e.g, error checks)

Models that pass this test can be safely handed to knowledgeable investors because they’re harder to break, and highlight errors easily.

Putting Model Building Into Action

The fastest path to a good model is to follow the logical sequence beginning with the conceptual model. But if you’ve already built a model, step back and evaluate it through the eyes of a knowledgeable outsider who doesn’t know your business. How easy is it to:

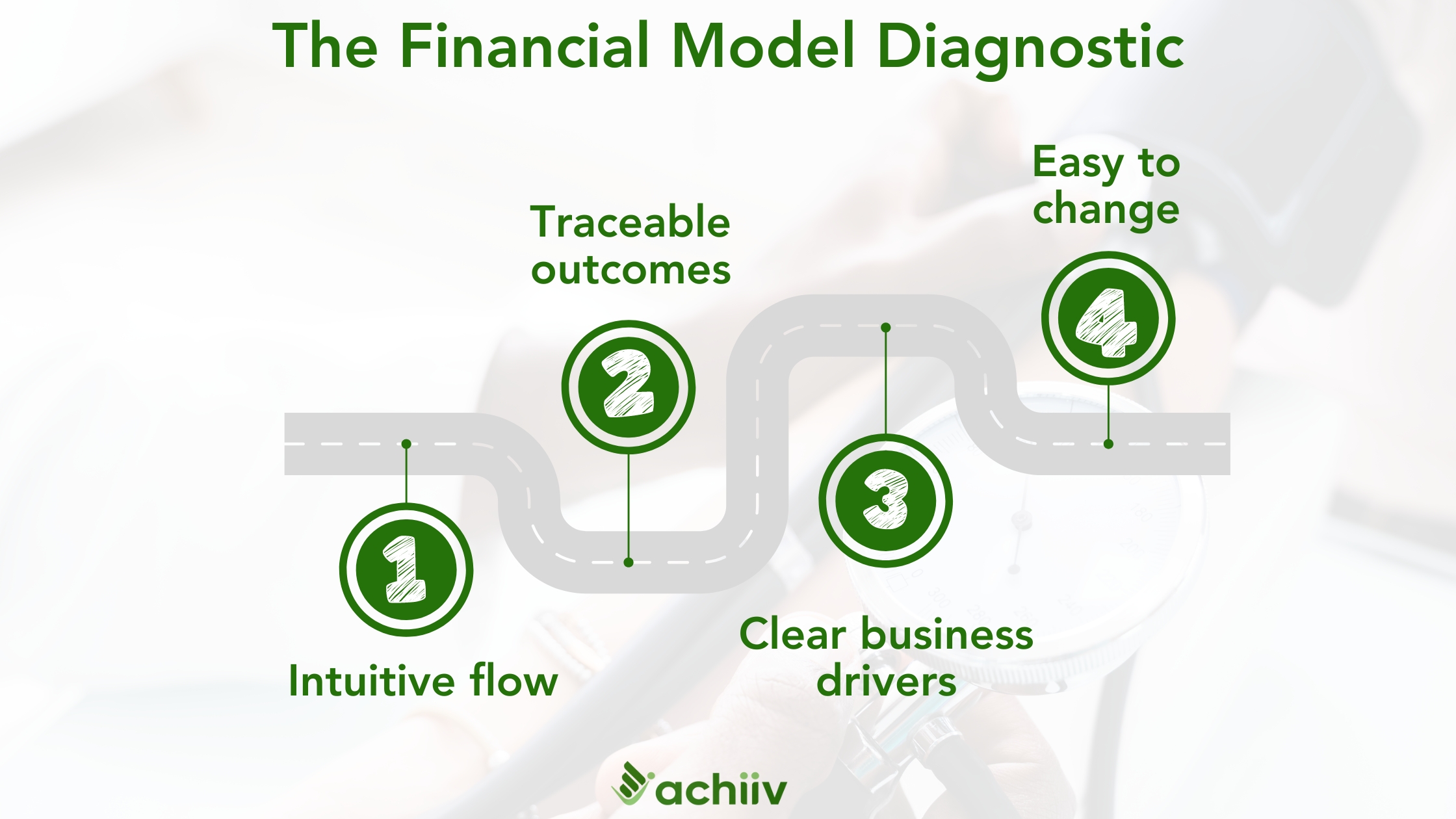

- Identify how activity and results flow through your model? Is the design intuitive and easy to follow? If not, start with the conceptual design to see what’s missing.

- Trace back to how any important result is derived without significant effort? Do math and logic errors automatically get highlighted without additional work? If not, restructure your model to show more detailed calculations for key outcomes, logically organized. Add error checks at every key step where possible.

- Find the big drivers of your results: assumptions about your sales, costs, growth? If not, work on separating inputs, calculations and outputs to mirror the core drivers of your business. Introduce color coding and labeling to make the results pop.

- Run scenarios and quickly show what critical outcomes have changed – without breaking the model or spending days to run each scenario? If not, create a scenario analysis section using templates and output sections, for example.

Even a small improvement will elevate the quality and credibility of your model and make you a better steward of your startup’s resources. You’ll also make a mammoth, unappetizing task more manageable, and unearth issues well before they flash warning lights to investors.

Who knows – you might even begin to enjoy building your financial model!