I once talked to a founder who had developed a revolutionary water purification technology that was not only 10X cheaper than existing options, but was also 10X more effective. The technology was a game changer but the founder ran into a problem when trying to raise capital.

How exactly would this make money? What were they planning to sell, and to whom? On what basis would money change hands? Would municipalities just pay them a big lump sum upfront for the equipment? Or pay based on the volume of water purified? Or do something completely different? These questions still hadn’t been thought through.

For many startups, especially in hard tech, the applications are so numerous that it feels like you’re limiting your upside by selecting just one path to monetization. You couldn’t be more wrong.

Why Your Monetization Strategy Matters

When you don’t have a clear monetization strategy, you lose the strongest indicator of your startup’s potential. Without this signal, investors will apply their own conservative guess, or just walk away.

But it’s not just about capital – it’s about every critical aspect of how you build your startup.

Your Market and Customer

How you charge for your product directly affects who can buy, and how they will fund the purchase. The water purification technology can be sold as equipment but its price could make it unaffordable for many in your market. You’ll have to settle for a smaller market, or find ways for customers to finance the purchase. In fact, Henry Ford practically invented the car financing industry so his customers could afford his cars. Selling the same technology as a service expands and possibly changes who you’re selling to and how much you can sell.

Your Revenue and Profit Potential

All else equal, big markets are better than small markets, because you have more opportunities to sell your product. But even within a big market, your opportunity is capped by how much revenue can be generated from each customer. For example, you can only sell a finite number of high-priced water purification units to municipalities worldwide. But if you charge municipalities based on the volume of water purified, your potential demand multiplies, and the period over which you can generate revenue expands greatly. The revenue and margin flows will vary based on each case, but the differences will be material for any investor.

Your Need for Funding

Your monetization strategy also directly impacts how much money you’ll need to raise, and when. If you decide to sell your technology as capital equipment, you’ll generate more cash sooner because you get cash upfront for every unit you sell. Your revenue potential will be lower, but you’ll probably achieve cash break even sooner, reducing the need for frequent and stressful capital raises. But you’ll give up a lot of revenue upside.

If you charge based on volume, you’ll generate much higher revenues long term. But you’ll need huge amounts of capital to build multiple water purification units near your big customers. So you’ll need to rely on more external capital for much longer.

What Drives Your Monetization Strategy

So how do you craft a strong monetization path? Start with three questions:

Who Benefits?

Typically, the person who gets the benefit also pays for the product. For example, you buy water purifiers for your home, and you use them. The greater the overlap between buyer and user, the easier your monetization gets.

Who is Incentivized to Pay?

Often, the person benefiting isn’t the one paying or can’t pay for it. Healthcare is a classic example: the employee benefits from your product but it’s the employer paying some or all of the costs. The incentive for them to pay is that they can keep employees happy and incur lower healthcare costs. Social media is a classic example of a “free” product that advertisers are happy to pay for because they can access new customers.

What are the Value Flows and Budget Blueprints?

Especially in B2B, the first question is, where in the organization does your product’s value show up? Second, which budget owner has the power and motivation to buy? Say you sell an AI-powered quality control system that drastically reduces production defects and decreases the need for labor. If the biggest bang is from reducing defects, monetization will focus on the value of reduced defects. If the impact is in reduced labor, monetization will focus on cost saves. The shift in value emphasis changes not just who approves the purchase, but also how the product is monetized. The biggest tactical issue is where the budget resides, and what’s needed to unlock it for your product. Ignore this detail at your peril.

How to Develop a Strong Monetization Strategy

Okay, so now you know the building blocks of your monetization strategy. What’s the secret to putting them together?

Lock Down Value

When Larry Page and Sergey Brin first built their search engine, it did its job better than anything anyone had ever seen. Yet, they struggled to get investors and buyers interested in it because they couldn’t articulate why anyone would pay for it – until they realized the value of search results to advertisers. The result is a company valued in the trillions.

Defining what value is, and to whom, is the single most critical and important step to building your monetization strategy. Value can come from different parts of your product or invention. For example, an AI-based diagnostics solution can not only help diagnose individual patients, but can also provide aggregated data for research purposes.

Can you develop a comprehensive map of sources and beneficiaries of your product’s value? Can you quantify it in a credible and objective way? If you’re selling a robotics system to manufacturers, can you quantify how much you’ll reduce not only labor costs but also reduce employee accidents?

Find The Budget

It’s critical not only to find out who has the means to pay, but what keys are needed to unlock those budgets. Sometimes it’s simple, like convincing a customer of the savings from buying your product. Other times, it may be more complex. For example, successfully monetizing your healthcare invention may require getting it reimbursability eligibility as well as use by healthcare providers.

Find and Activate Triggers

It’s not enough for your product to offer an insane amount of value and for there to be a budget to pay for it. The most important third element is an activating factor – a trigger that makes it easy or imperative for the buyer to say “yes”. Inertia is the biggest enemy of sales, and humans even in big B2B purchases need very solid and convincing reasons to do things differently.

What’s the trigger that will mobilize your buyer? Here’s where you can get creative in your approach. I recently interviewed an incredibly enterprising founder on my podcast, who essentially created a market by having a new law passed that would make her product the easiest and fastest path to compliance. Genius!

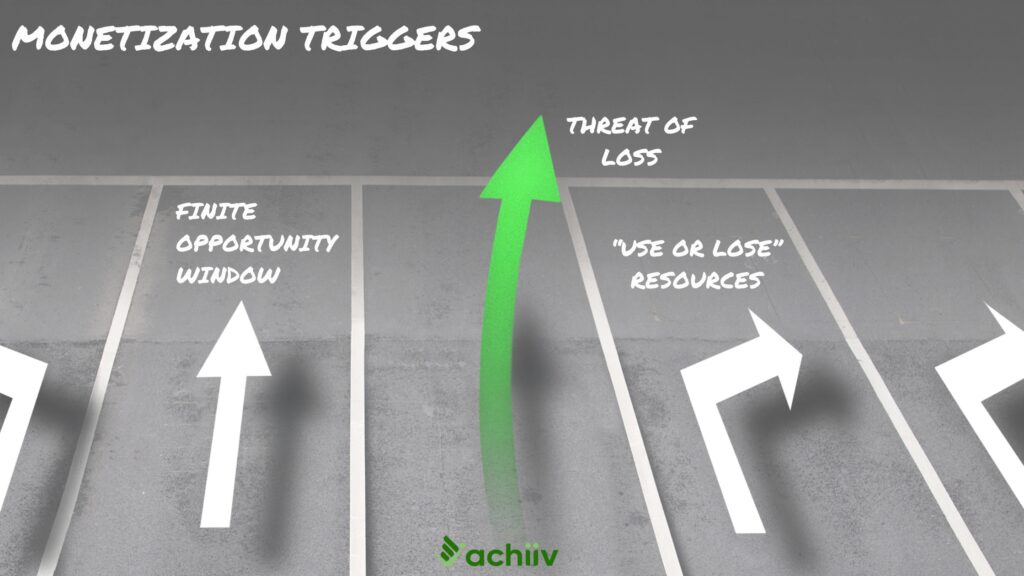

Some reliable triggers that are proven to work:

- Threat of loss or pain (think legal risks or compliance risks that could become prohibitively costly for your buyer)

- A window that closes soon: For example, incentives that are set to expire within a finite time frame

- Resources that are “use or lose”: Grants, budget allocations, and the like

There can be many more, limited only by your deep knowledge of your market and industry.

With these critical elements in place, you’re now well on your way to defining your monetization strategy

- Define your buyer. Is it the end-user, an enabler (like an employer or insurance provider), or an “assembler” – someone who uses your product in their product

- Fix the unit: Will you sell units of product, time (subscriptions) or installations (e.g., charge based on number of cameras installed)

- Define the structure: Will you monetize based on a simple structure, i.e., one price per unit? Or will you create a more complex structure, like a base price plus a usage based fee, for example?

Develop a few strawman concepts that track with value, align with big budgets and activate the trigger to purchase and you’ll be well on your way to mastering monetization!

Hat tip to my friend and angel investor Brian Kerns, who was instrumental in helping me develop some of the core ideas in this post.